You’re staring at a stack of financial documents, overwhelmed and unsure where to start. Sound familiar? Many professionals dive into accounting without realizing they’re missing a crucial foundation—Pre-Accounting.

If you’ve ever felt confused by basic financial tasks, or wondered why your spreadsheets just don’t add up, you’re not alone. And more importantly, it’s not because you’re “bad with numbers.”

Let’s clear the air: Pre-Accounting isn’t just busywork. It’s the groundwork that makes everything else possible.

The Hidden Truth About Pre-Accounting

So, what exactly is Pre-Accounting?

Put simply, it’s the bridge between raw financial data and organized accounting processes. Think of it as setting the stage—without a solid setup, even the best performers can stumble.

“A strong start prevents messy corrections later.”

But here’s the twist—many assume that if they know Excel or have a calculator, they’ve got this covered. Not quite.

Pre-Accounting involves:

- Understanding how transactions flow through systems

- Recognizing source documents and their purpose

- Knowing how to classify different types of entries

- Familiarity with basic business operations behind the numbers

This is where so many myths come from—and why we’re busting them today.

Myth #1: Pre-Accounting Is Just Basic Math

Let’s get one thing straight: Pre-Accounting isn’t about crunching numbers all day.

Sure, there’s math involved—but it’s more about logic., pattern recognition, and understanding business language.

Most mistakes happen when someone skips the logical setup phase and jumps straight to calculations. Like trying to build a house without a blueprint.

This misconception leads professionals to underestimate its importance and skip critical steps, which often result in errors downstream.

Myth #2: You Only Need Pre-Accounting If You’re an Accountant

Wrong. Dead wrong.

If you work in project management, sales, HR, operations, or even run your own small business—you interact with financial information daily.

And if you don’t understand how those numbers came together, you could easily misinterpret reports, budgets, or performance metrics.

Here’s what most non-accountants miss:

- How entries affect multiple accounts

- Why timing matters in recording transactions

- Which documents support financial accuracy

These aren’t minor details—they’re mission-critical skills that boost confidence and reduce costly misunderstandings.

Myth #3: Pre-Accounting Skills Are Too Time-Consuming to Learn

We hear this one a lot. Especially from busy professionals juggling deadlines, meetings, and endless emails.

But let’s flip that around: How much time do you waste double-checking spreadsheets, chasing down missing documentation, or explaining discrepancies to auditors?

Investing even a few hours learning foundational Pre-Accounting principles pays off quickly.

Instead of floundering every month-end close, or struggling during budget season, imagine moving through financial workflows smoothly and confidently.

That peace of mind alone is worth the effort.

Myth #4: Tools Will Handle Everything Automatically

Automation has transformed modern finance—but that doesn’t mean humans can check out completely.

Software only works well when users input correct data correctly classified at the right time.

Without proper data hygiene practices, even the best tools produce inaccurate outputs—a classic case of “garbage in, garbage out.”

Think of automation as having a sous-chef who helps speed things up—but you still need to plan the menu and prep ingredients properly.

Real-World Impact: When It Goes Right vs. Wrong

Let’s take a quick look at how mastering Pre-Accounting changes outcomes:

- A manager who understands transaction sources catches invoice duplicates before payment

- An entrepreneur avoids late penalties after recognizing recurring billing dates early

- A team reduces month-end stress by knowing where each report pulls data from

On the flip side, skipping these basics usually means:

- Misaligned budget forecasts

- Inaccurate reconciliation issues

- Lack of internal control awareness

Sound familiar? That’s because most professionals encounter these challenges—but fewer realize how easily they can be resolved with structured preparation.

Beyond Basics: Advanced Tips for Mastering Pre-Accounting

Now that we’ve cleared away the confusion, let’s talk strategy.

To really master Pre-Accounting, focus on these key areas:

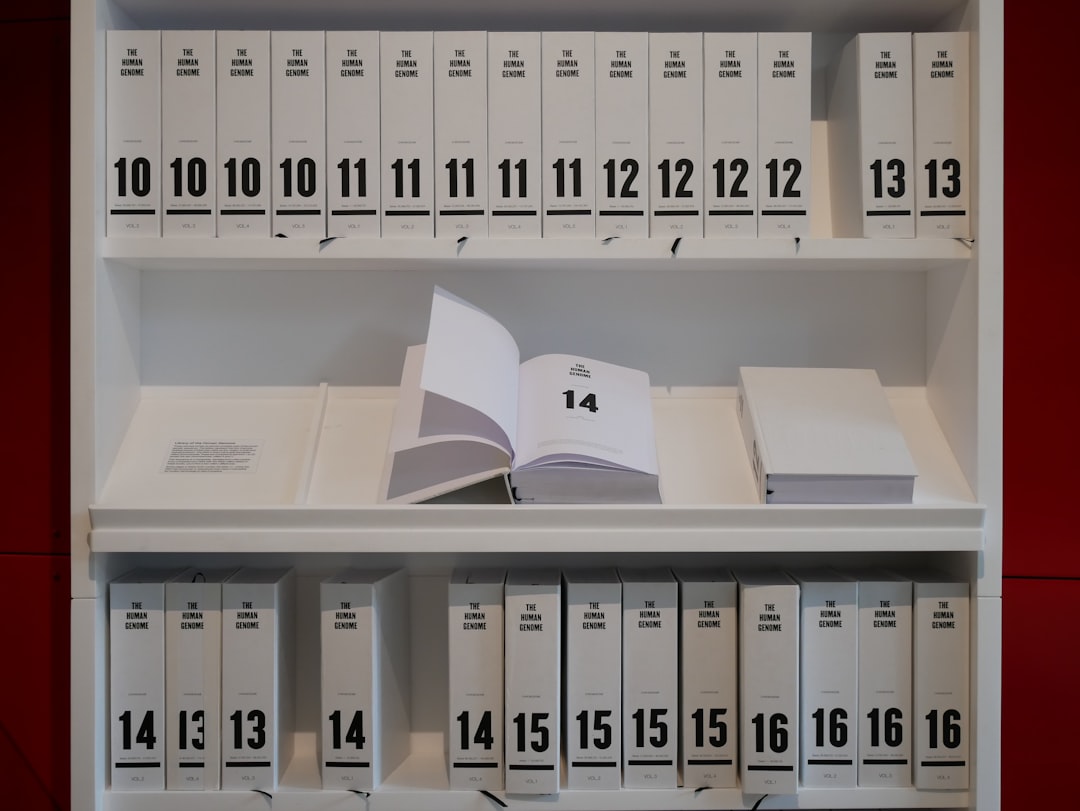

Document Mapping

Get comfortable identifying and linking source documents to corresponding entries.

Start with common ones like invoices, receipts, purchase orders, and bank statements. Notice patterns in how they connect to journals and ledgers.

Workflow Visualization

Create simple diagrams showing how a typical transaction moves from inception to final entry. This mental model becomes invaluable under pressure.

Error Spotting Intuition

Train yourself to spot red flags early—unbalanced entries, mismatched dates, missing references.

The faster you identify anomalies, the less risk of compounding problems downstream.

Data Entry Discipline

Establish routines for accurate classification and timely recording. Treat it like muscle memory—it saves effort long-term.

Ready to Get Started?

If you’re ready to stop second-guessing your financial setups and start working smarter—not harder—you owe it to yourself to explore structured training options.

Our comprehensive course dives deep into practical Pre-Accounting techniques tailored for busy professionals like you. Whether you’re new to finance or looking to refine existing habits, Pre-Accounting gives you tools that stick.

Don’t wait until next quarter rolls around and old frustrations resurface. Bookmark this page now, and consider taking action today.